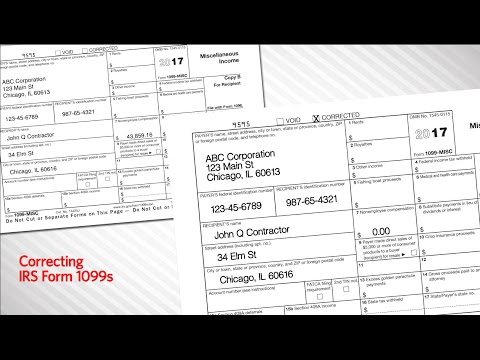

Music Wyson associates presents correcting Form 1099 is the federal income tax. It is perfectly legal within the limited territorial jurisdiction of the national government in Washington DC and its US territories. However, this is not the case when considering the constitutional republic and the fifty states of the union. The federal income tax's jurisdiction is limited within the constitutional republic due to the US Supreme Court decision in 1895 in the Polish Farmers' Loan and Trust case. The Court declared that the federal income tax is a direct tax and can only be applied toward American nationals. This definition of American nationals includes the rule of apportionment as stated in Article 1, Sections 2 and 9 of the Constitution. Without adhering to this requirement, the Supreme Court deemed the tax unconstitutional. President Taft affirmed this in his letter to the US Congress regarding the legislative intent of the sixteenth amendment. The sixteenth amendment, created by the US Congress, did not include the rule of apportionment requirement and therefore does not apply within the 50 states of the Union. The federal income tax is only levied upon the national government and certain sub-classifications of US taxpayers, none of which include American nationals in the private sector of the constitutional republic. Many Americans receive IRS Form 1099 from their private sector employers or others, which are tax classified information returns. These Form 1099s are sent to the IRS by anonymous individuals who create them. The creator of the form is not required to identify themselves, and there is also no requirement for any statement on the form that the creator is acting under penalties of perjury. The IRS accepts these Form 1099s as reported income without verifying the accuracy of the information. Other types of tax classified information returns include Form...

Award-winning PDF software

Video instructions and help with filling out and completing Who 8850 Form Recipient