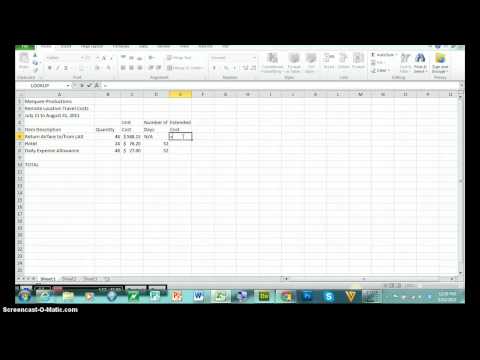

Okay, when working in Excel, I want to point a few things out to you. Here's an Excel spreadsheet. A few things to remember: 1. Do not have any blank columns. 2. As you can see here, column B, even though it looks like there's something in it, there's really nothing in it. When you click here and make column A wider, you can see everything is in column A. There is nothing in V or C. So, to delete those columns, I'm going to select them like that, then I'm going to right-click and delete. 3. The next thing: You need to determine a unit cost. So I'm reading the directions for this assignment. This is Assessment One and it looks like the return airfare to and from LAX is $588.15. Okay, the unit cost for one hotel stay, according to the directions, is $76.20. And the daily expense allowance is $27. 4. Now, quantity. That's the number that we're going to purchase for each one. Unit cost, obviously, that's a dollar amount. So I'm going to select those and I am going to come up here to my home tab and I'm going to click the dollar sign. That'll make them all have two decimal places and a dollar sign. If you want to adjust decimals, you just use these two buttons up here: decrease and increase. 5. Number of days, obviously, that should be a whole number. That's the number of days. 6. Now, we need to make a calculation. We need to calculate the cost. Whenever you do a calculation in an Excel spreadsheet, always start off the formula with an equal sign and then always include cell addresses as much as possible. Try to avoid typing in actual numbers. 7. For instance, if I were...

Award-winning PDF software

Is wotc mandatory? Form: What You Should Know

ROTC Increase Your Chances of Reaching Top 10 Percent for Your State. Get Start Today No more excuses! If you work for a taxable company in California, you have a lot to gain from the ROTC if you will participate. What if I don't complete the ROTC form? Even if an employee is not required to complete the ROTC form before returning to work, it is still highly recommended that you complete the form and have all information on your employee for the purpose of tax filing and reporting. The EDD may require that you submit the ROTC report when you complete your tax return. What if I fail to file the IRS Form 4868 or the EDD form? If you fail to complete and return any part of the required Forms 4868 or EDD, the employee's pay may be subject to tax penalties, and you may be held liable for the payment amount. Employer Information Employers must follow the specific instructions for completing ROTC forms for employees if the employer's name or address is on the Form 4868 or EDD. If the employer's name or address on the Forms 4868 or EDD does not match the name of the person's business that the employee attended ROTC school, the employer may be required to verify that the employee attended the ROTC school, and if the employer cannot verify the attendance, the employee may be held liable for the payment amount. This is because the form requires that the employees name be on the back; if the name on the back does not match the employer, there would be a match (as noted) and the employee could be subject to IRS reporting and penalties. The EDD form does not list the names of businesses which are part of ROTC or EDC. Employers who are required to file their taxes with the IRS will find the information on the IRS website on the ROTC form is identical to what is contained on the Forms 4867 and ED906. Therefore, this information provides a solid understanding of how the ROTC form and forms may apply to employers. What if my state does not recognize ROTC? If you are a part of the California State Uniformed Services University Reenlistment and Education Commission (USA REC), you will be issued a copy of the form, and you may use it to complete your tax return.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8850, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8850 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8850 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8850 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Is wotc mandatory?